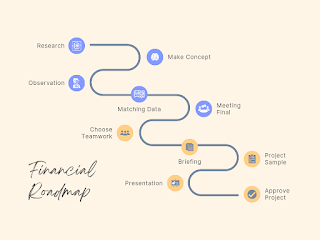

Creating a Roadmap to Financial Success: Setting and Achieving Your Financial Goals.

Setting financial goals: a guide

A crucial first step to gaining financial freedom is setting financial goals. Having a solid plan in place can help you keep motivated and focused, regardless of whether your objective is to pay off debt, save for a down payment on a home, or retire comfortably. The following are important steps for setting financial goals:

Set your objectives:

Establish your financial objectives first. Set deadlines for completing each goal and be sure to be precise and measurable. For instance, you might want to save $20,000 for a down payment on a house within the next three years or pay off $10,000 in credit card debt within the next year.

Establish a starting point:

Understanding your existing financial condition is necessary before you can make reasonable financial goals. Make a list of your earnings, costs, debt, and savings. This will assist you in finding areas where you may reduce spending, boost your income, or put more money toward your financial objectives.

Organize your objectives into more manageable milestones:

Achieving a sizable financial goal all at once can be overwhelming. Divide your objectives into smaller, easier-to-achieve milestones. If your objective is to save $20,000 for a down payment on a house within the next three years, for instance, divide it into smaller goals like saving $500 per month.

After you've determined your objectives and benchmarks, establish a strategy for reaching them. This could entail creating a budget, bringing in more money, spending less, or saving aside more money each month for your goals. Along the process, make sure to keep an eye on your progress and adapt as necessary.

Remain motivated;

reaching financial objectives requires time and work. Reminding yourself of the advantages of reaching your goals will help you stay motivated. Celebrate your progress along the journey and the improvements you will experience as a result of your efforts.

Rethink and adapt:

You might need to rethink and adapt your goals when your financial condition changes. To make sure that your goals are still attainable and pertinent, be adaptable and ready to make modifications as necessary.

Setting financial objectives is a crucial first step to gaining financial freedom, to sum up. You can take charge of your money and reach your financial objectives by identifying your goals, figuring out where to start, breaking them down into smaller milestones, making a plan, keeping motivated, and reevaluating and adapting as necessary. Keep in mind that establishing and accomplishing financial objectives is a journey that calls for persistence, self-control, and a well-thought-out strategy.

Comments

Post a Comment