Stay Financially Organized with a Comprehensive Personal Expense Tracker

I strongly advise using a personal cost tracker to keep tabs on your expenses as a financial expert. It is a crucial tool for good money management and reaching your financial objectives.

A device or piece of software that enables you to track your own spending is called a personal expense tracker. It aids in expense categorization, habit tracking, and budget creation in line with your financial objectives. You can find areas where you can reduce spending and save more money by keeping track of your expenses.

Here are some pointers to assist you efficiently utilize a personal spending tracker:

- Pick the best expenditure tracker: There are a variety of expense trackers on the market, from straightforward spreadsheets to sophisticated software. Pick the option that works best for your needs and budget. To keep track of your spending, you can also utilize free applications like PocketGuard, Personal Capital, and Mint.

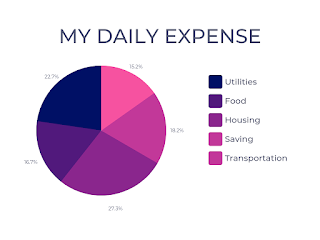

- Create categories for your spending, such as those for accommodation, food, entertainment, and transportation. You will be better able to keep track of your expenditures accurately and find places where you may cut back.

- Regularly keep track of your spending: Make it a routine to keep track of your expenses each day. This will assist you in monitoring your spending and preventing overspending.

- Create a budget that works for your financial objectives using your expense tracker. Set and adhere to spending caps for each category.

- Analyze your spending: Examine your spending patterns using the information from your expense tracker. Decide where you can save costs and adjust your budget accordingly.

- Prepare for unforeseen costs: Your personal expense tracker can assist you in preparing for unforeseen costs such as house repairs, car repairs, and medical bills. To be ready for these expenses when they occur, save aside some money each month.

- Being truthful with oneself is essential when using a personal cost tracker to determine your spending patterns. Avoid attempting to cover up or rationalize pointless costs. Your ability to achieve your financial objectives will only be hampered by this.

- Utilize your expense tracker to keep tabs on your advancement toward your financial objectives. Celebrate little victories along the road, such as lowering a particular category of spending or staying within your monthly budget.

- Regularly review your expenses: Schedule time each month to examine your spending and make necessary budget adjustments. This will enable you to continue working toward your financial objectives.

- Make wise financial decisions by using your cost tracker: You can use the information you get from your personal spending tracker to make wise financial decisions. You can use your spending tracker, for instance, to decide whether you can afford to buy a new automobile and how it would affect your entire financial condition.

In conclusion, a personal expense tracker is a crucial tool for wise money management. You may attain your financial goals and create a more secure financial future by keeping track of your spending, creating a budget, and examining your spending patterns. So get a personal cost tracker and start using it right away to gain financial management.

Comments

Post a Comment